What is a Merchant?

The supermarket chain near your house with the best chocolate selection. The taxi company which takes you home safely after a night out. The online store which sells your favourite brand of sports equipment. Your business – whether it is online or a brick and mortar store or restaurant. What do they all have in common? They’re merchants.

Merchant? Like in medieval times? Well, yes and no.

Merchant is the term used in the payments industry to describe companies that sell goods or services, and it’s true, the word has been around to describe as much since the middle ages. Merchants today can be either stores, restaurants, or online businesses. To accept card payments, brick and mortar businesses need payment solutions such as POS terminals to accept cards in-store or virtual terminals to take phone orders. Ecommerce businesses, on the other hand, need payment webpages or online shopping carts to accept payments on their websites.

But to do that, these businesses first must have a merchant account.

Then, What is a Merchant Account?

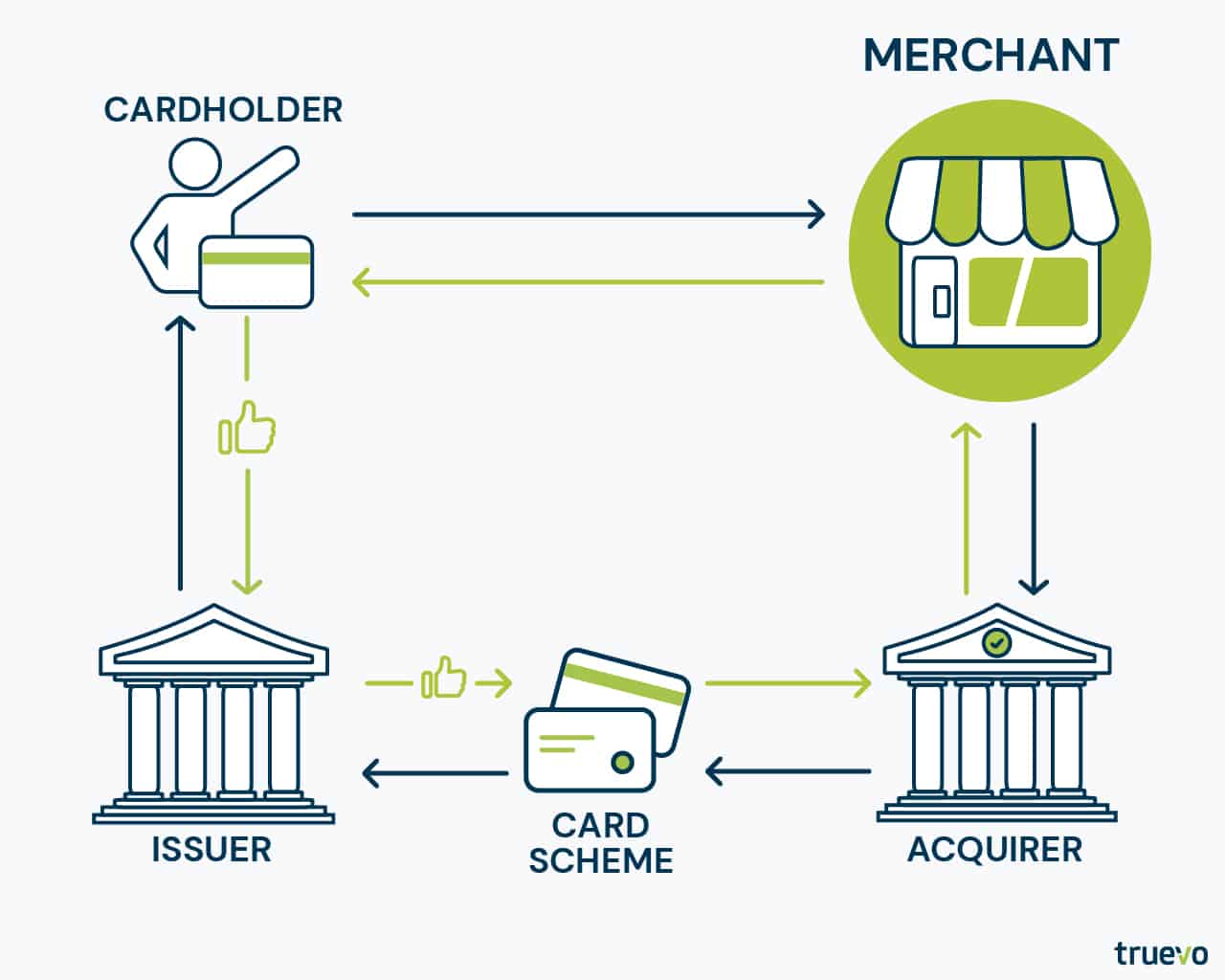

A merchant account is a type of account merchants need in order to receive card payments. These are most often provided by acquirers. Acquirers help merchants get paid by facilitating the card payments with card schemes and issuing banks. They assist merchants to accept payments safely, protecting their data, and those of their customers. In return, the merchant pays some fees, usually based on a percentage and / or a fixed fee per transaction.

Brick and mortar stores that only choose to accept cash are not required to open a merchant account. These businesses can rely solely on a deposit account at a bank. Any other business needs a merchant account.

A merchant account is critical not only to offer card and electronic payment options to customers, but to prevent fraud and protect sensitive data. Acquirers must meet rigorous security standards as required by the financial services industry and by card schemes.

One alternative for businesses is to go through a payment aggregator. This type of organisation is best suited to startups or businesses that have a high chargeback risk and a low volume of transactions. Payment aggregators allow merchants (known as sub-merchants) to accept card payments without opening a merchant account. Instead, the merchant’s funds are paid into the aggregator’s merchant account, then transferred to the sub-merchant’s account. At this point, the merchant can withdraw the funds as needed.

Ok, I Need a Merchant Account. How Can I Get One?

Luckily for merchants, the acquiring industry is highly competitive so there are great rates and service packages for all types of businesses. Applying for a merchant account isn’t complicated, but it does require some paperwork. Since acquirers accept the risk of taking payments on behalf of merchants, they must look at a variety of criteria to approve businesses for merchant accounts. The types of materials merchants typically need to provide include:

- Business details (Company registration number, VAT, Tax ID number, business type, etc.)

- Estimated monthly turnover and average transaction value

- Bank details

- Director and Ownership details

Having these on hand when applying for a merchant account will make the process easier and faster.

When choosing an acquirer to apply with, you should bear in mind the acquirer’s fees and their contract. The best thing to do is to ask for quotes, compare different providers, read conditions carefully, and see what kinds of offers are out there. Also, it’s important to ensure that the acquirer processes payments safely. For example, good questions to understand about your future acquirer is whether or not they are PCI-DSS compliant.

Have an Ecommerce Business? You’ll Also Need a Payment Gateway

If you own an online business, then you need to consider one additional element to be able to accept cards. You need a payment gateway in addition to your merchant account. Payment gateways are necessary for online businesses to allow payment data to be captured and transferred to your acquirer and your customer’s issuer. The payment gateway acts as a protector of your customer’s data, fights fraud, and detects different situations that might cause chargebacks. These include things like insufficient funds, card failures, or when cardholders have exceeded their credit limits.

Ask prospective acquirers whether they also provide payment gateway services. But, if you prefer to use an independent payment gateway or have one already, it’s important to check that the payment gateway is compatible with your acquirer of choice. Keep in mind that depending on the type of gateway you choose, you may need developers to integrate the gateway to your website.

The Bottom Line

In the payments industry, brick and mortar or online business are considered to be “merchants”. If you would like to accept card payments, you need a merchant account. Acquirers, like Truevo, are great places to apply for a merchant account and to set up card payments for your business.

Have questions about merchant accounts or payments? We have answers. Feel free to reach out to our team.