Unfortunately, there are some bad people in the world. And a lot of them are lurking on the internet. Data is juicy bait for the millions of predators stalking through the networks—credit card data, passwords, bank account numbers… each are all too tempting information ripe to be exploited. Every piece of data is susceptible to being stolen, especially when every day, billions of transactions occur. That’s why security methods like 3D Secure (3DS) were created.

As a consumer, you have more than likely used it on occasion; You decided to buy that new pair of shoes you’ve been eyeing online. You’ve entered your information on your shoe store’s payment gateway, and suddenly you go to an extra page. On it, there is a message from your bank asking for an additional verification step. You are required to enter a code or the pin they just sent to your phone.

This is precisely the extra step that is known as 3DS, and due to PSD2 regulations, all merchants need to send transactions that are authenticated via this system.

After all, merchants are accountable for every payment transaction on their websites, and they have the responsibility of meeting the security standards of the major card schemes. The good news is that complying with them doesn’t only increase security; 3DS also saves time and money. How? Well, according to Ethoca, more than 50% of digital commerce transactions listed as suspicious of fraud are actually legitimate.

3DS authenticates transactions from the beginning, improving security and helping merchants to make more money at the same time. Would you like to know more? Keep reading!

What Is 3D Secure?

3D Secure (3-domain structure) or 3DS is a security protocol or technical standard currently developed and maintained by EMVCo and implemented by the payment card industry. This system requires an additional step when it comes to user identification and verification. Its final goal is to avoid fraud related to credit and debit card transactions and to protect both the customer and the merchant.

How Does 3D Secure Work?

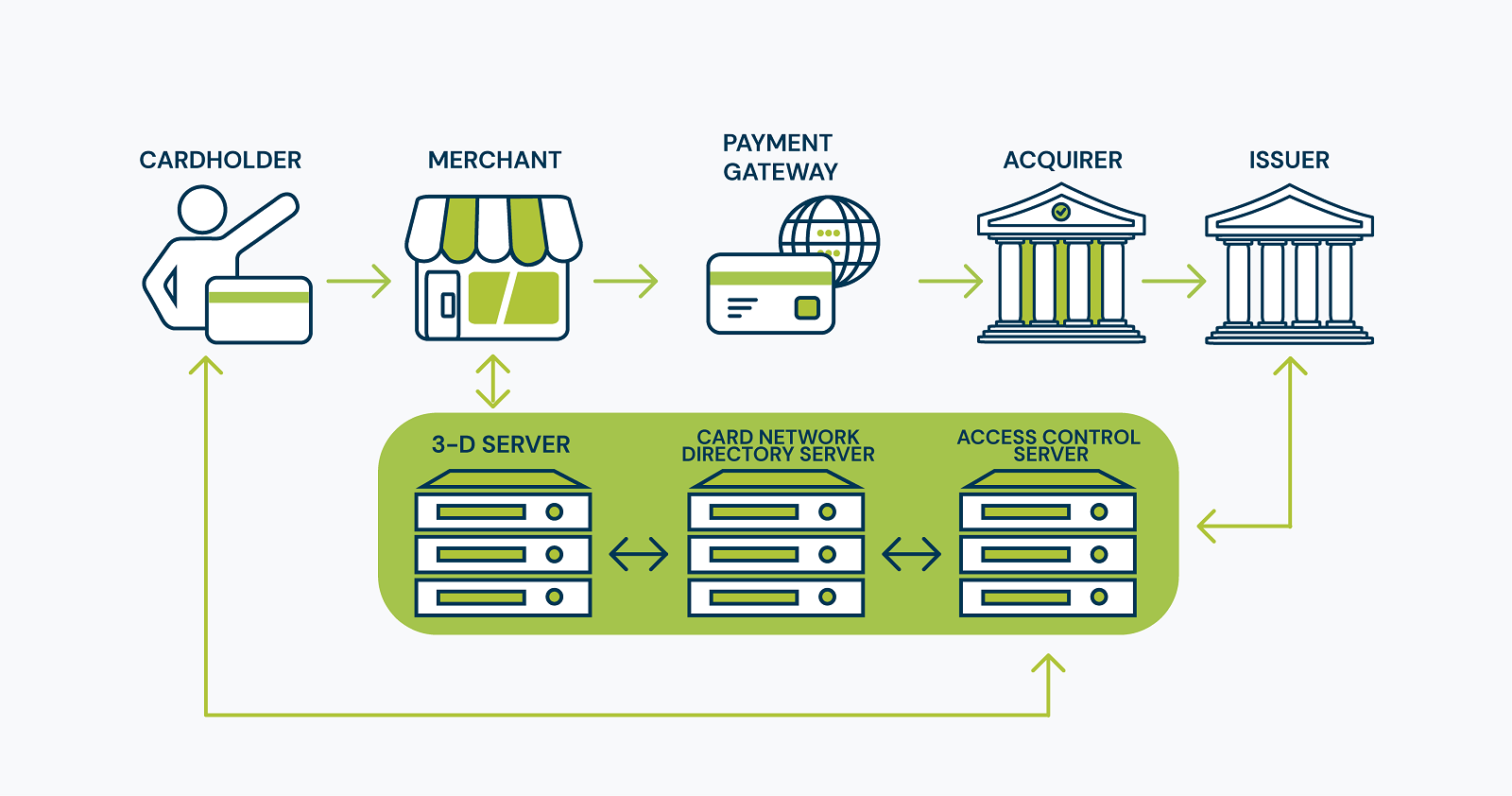

If we had to get technical, we’d start by saying that 3DS systems are a part of the merchant’s payment gateway. A transaction with no 3DS goes from the cardholder to the merchant and then to its acquirer. The acquirer sends the request to the issuer through the card scheme, receiving the response and sending it back to the merchant, accepting or denying the operation.

A 3DS system adds several additional layers of security to this process. The transaction goes from the cardholder to the merchant, and then to a directory that confirms that it has 3DS registration. This confirmation redirects to an additional page of the issuing bank in which extra authentication is requested through a OTP (one time password) or code. The authenticated result goes back to the directory, launching it into the acquirer, and continuing with it.

What Is 3D Secure Version 2?

3DS has come a long way. The newest version, Version 2, dropped in 2019. And let us tell you, it is everything merchants had been demanding. It’s also fast becoming the new normal as all merchants are mandated to adhere to 3DS Version 2 by the end of 2020.

Merchants’ major complaint about 3DS was the friction added to the buying process. Forcing customers to insert more and more data, taking extra steps to secure transactions kills impulse buys, and negatively impacts bottom lines due to cart abandonment.

What merchants need to know is that version 2 of 3DS doesn’t affect transactions or interactions with merchants and cardholders negatively. Capturing more details of the cardholder upfront and sending them to be examined by the issuer from the beginning results in better and frictionless buys. How? It’s quite straightforward.

With 3DS version 2, cardholders get upfront authentication. Merchants identify the cardholder from the start, collecting more info, and sending it through. Elements such as the cardholder IP, the location associated with that IP, or browser authentication are collected and sent to the issuer, who decides to authorise or challenge the transaction, using in most cases an OTP.

The 5 Main Advantages of 3D Secure

Reduce the chance of credit and debit card fraud

With the extra user authentication step, the merchant reduces the possibility of fraud on its website. Also, the whole process manages to protect customer data better. The significant increase in security also increases confidence and trust in the merchant’s brand.

Minimise the risks of chargebacks

A 3DS system guarantees that the owner of the card is the one who ordered the transaction. Thanks to the system, fewer fraudulent profiles will be able to make purchases in the merchant’s e-commerce.

Change responsibility for chargebacks

Thanks to 3DS systems, liability is transferred to the issuer. If one of the cardholders complains that there has been an unauthorised transaction on their card, it will be the issuer to take care of the refund. And more security also means fewer settlements to worry about, saving time and money.

Improve chargeback ratios

3DS reduces the number of payment disputes which results in lower chargeback ratios and results in benefits from card schemes.

Useful for recurring transactions

Recurring transactions can create problems for merchants since there are lots of disputes associated with them. Subscriptions services are often disputed due to the cardholder not remembering subscribing to the service. Thanks to 3DS, there is always a link to the original transaction that was authenticated for the first time. The cardholder can dispute the transaction if not satisfied with the service or if they have cancelled the service. However, they cannot dispute the recurring transaction as fraud since the first was authenticated.

3D Secure Sounds Great!

Indeed it does! To learn more about 3DS, talk to your payment provider. Truevo has already integrated it into its service, helping merchants to implement and be compliant from the beginning. But there is still work to do from the merchant, who needs to do some integration and implementation in their internal software.

But luckily, we are here, ready to help you set it up! Reach out to our team to learn how we can get you rolling with 3D Secure.