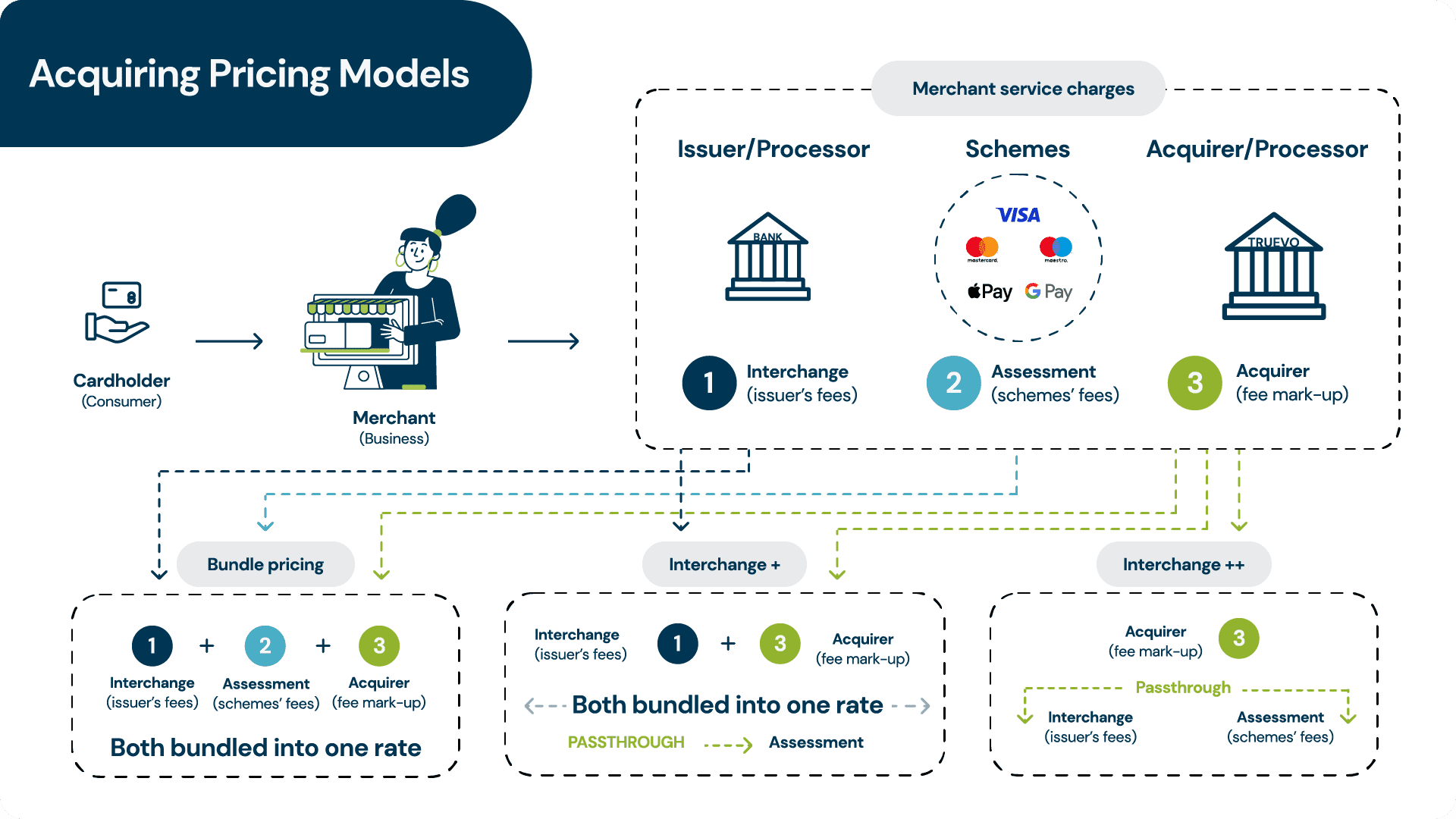

As online payments continue to dominate the global financial landscape, understanding the complex web of relationships and pricing structures within the acquiring space is crucial for business owners. In this blog post, we delve into various acquiring pricing model structures and shed light on the processes involving cardholders, merchants, issuers, schemes, and acquirers.

We will explore various pricing models, including Bundle Pricing, Interchange+, Interchange++, and their associated components. But before we dive in, let’s lay the land with these definitions.

Interchange fees: Charged by the cardholder’s bank (the issuer), these are the people that place a card in your hand.

Card scheme fees: What the card scheme charges for using its network (first +).

Acquirer’s markup: What acquiring bank charges for their services, ensuring the funds are taken from the cardholder and reach the merchant’s bank account quickly and securely (second +).

Let’s dive in!

Cardholder to Merchant: A Transaction Journey

When a cardholder makes a purchase, the transaction involves multiple entities working together seamlessly. The journey starts with the cardholder initiating payment using their credit or debit card. The cardholder’s issuing bank (issuer) validates the transaction and approves or declines it based on the cardholder’s available funds or credit limit.

The Role of Issuers

Issuers are financial institutions that provide credit or debit cards to cardholders. They access the cardholder’s accounts, handle transaction authorisations, and assume the risk associated with cardholder defaults. In terms of pricing, issuers offer various pricing models to merchants, including Bundle Pricing and Interchange+.

Issuers offer a Bundle Pricing package (also known as Blended or MDR Pricing), bundling interchange (issuer’s fees), assessment (schemes’ fees), and acquirer fee markup. This pricing model simplifies the cost structure for businesses and provides predictability in their payment processing expenses.

In addition to Bundle Pricing, issuers may offer Interchange+ pricing. Interchange fees are the fees paid by the acquirer to the issuer for processing the transaction. Interchange+ pricing adds the acquirer’s fees on top of the interchange fees, providing a more transparent breakdown of costs for businesses.

Understanding Card Schemes

Payment schemes, such as Visa, Mastercard, and other major card networks, facilitate the flow of transactions between cardholders, merchants, and issuers. These schemes set the rules, regulations, and standards that govern payment processing. In the context of pricing, schemes typically offer Bundle Pricing to acquirers. For more information on Truevo’s card scheme fees for Interchange++, visit this page.

Schemes offer Bundle Pricing that includes interchange (issuer’s fees), assessment (schemes’ fees), and acquirer fee markup. This bundled approach simplifies pricing for acquirers and ensures consistent rates across different businesses within the scheme.

The Role of Acquirers

Acquirers are financial institutions or payment processors that enable businesses to accept online payments. They serve as intermediaries between the merchant and the schemes. Acquirers work closely with schemes to facilitate payment transactions and provide merchants with the necessary infrastructure to accept various payment methods.

Acquirers charge fees according to different pricing models and generally use three models to calculate these fees.

Acquirers receive Bundle Pricing from schemes, which includes interchange fees (issuer’s fees), assessment (scheme’s fees), and acquirer fee markup. This consolidated pricing model simplifies the merchant’s understanding of payment processing costs.

Acquirers may also offer Interchange+ pricing to merchants. In this model, the interchange fees charged by the issuer are passed through to the merchant, with the acquirer adding its own fees on top. Interchange+ provides greater transparency by separating the interchange fees from the acquirer’s charges.

Acquirers, such as Truevo, may offer an enhanced pricing package known as Interchange++. This model includes interchange (issuer’s fees), acquirer fees, and an additional premium charged by the acquirer. This pricing structure is suitable for merchants who prioritise additional services or value-added features.

Understanding Fees: Passthrough and Merchant Service Charges

Within the acquiring pricing model, it’s essential to differentiate between passthrough fees and merchant service charges.

Passthrough fees, such as interchange fees and assessment fees, are charges incurred by the acquirer from schemes and issuers. These fees are "passed through" to the merchant without markup, ensuring transparency in the cost structure.

Merchant service charges encompass the fees charged by the acquirer for providing payment processing services to the merchant. These charges cover the acquirer’s operational costs, customer support, risk management, and value-added services. They are typically added on top of passthrough fees to create the overall cost structure for the merchant.

Understanding the acquiring pricing model and its various components is vital for businesses aiming to optimise their payment processing costs. By comprehending the roles of issuers, schemes, and acquirers, as well as the pricing models they offer, business owners can make informed decisions regarding their payment processing solutions. Whether opting for Bundle Pricing, Interchange+, or Interchange++, merchants can navigate the acquiring landscape with clarity and transparency, empowering them to focus on growing their business.

Switch to a payment provider that delivers simple, secure online payment processing that just works, reach out to Truevo today.