[3-minute read]

Have you ever been a victim of payment fraud? Here’s what happened to Eric. He is an online retailer selling mobile accessories. He gets over 20 orders per day. He always assumes that his orders are genuine and promptly ships his product to customers overnight. Eric, happy with his business, is unaware that some orders are fraudulent. Some purchases were made using credit card information stolen or simply bought on the internet.

A few weeks later the real card owners notice the suspect charges on their statements.

They file charge reports and their banks fittingly release chargebacks for those payments. Now, Eric finds himself in quite a bind. He’s been penalised with many costs like chargeback fees, investigation fees and faces the cost of the lost stock. What’s worse, if these incidences continue, his online credit card facility might be terminated because of the growing risks. Eric needs a solution, quick.

So, what’s payment fraud?

Attempted or completed by a cybercriminal, payment fraud is any type of false or illegal transaction. Through the use of the internet a victim’s money, personal information, or property is either moved or taken.

In the 21st Century, ecommerce businesses depend on electronic payment methods to charge their customers for products and services. The rapidly advancing technology and ever growing electronic transaction volume have created fertile ground for cybercriminals. This has resulted in increased fraudulent activity globally.

Payment fraud affects both businesses and customers. And, it can be difficult to spot suspicious activity. The smartest and tech savvy of people can be duped by a clever fraudulent scheme.

Payment fraud is described in three specific ways:

- An unauthorised or false transaction

- False requests for a refund, return or bounced cheques

- Stolen or lost stock

These are the most common ways, but in an advancing world, tactics are constantly changing. With ecommerce fraud reaching $ 20 billion in 2021, Payments Dive looks at payment fraud activities and trends to keep both businesses and consumers alert.

The different types of fraud

There are many forms of payment fraud across different platforms.

- Phishing – This often comes in the form of emails and websites that request private information such as a bank account, credit card, or an identification number. Unfamiliar platforms that source this kind of data are likely to be phishing to steal personal information.

- Identity theft – There are many kinds of identity theft in the real world, but it happens mostly online. Taking personal information to use it under pretence is participating in identity theft. Hackers target old security systems to break through their firewalls or hijack login details over public Wi-Fi.

- Pagejacking – By hijacking some of your traffic and directing it to a different website, hackers can reroute visitors from your ecommerce website. In this case, the unfamiliar site likely has malicious software installed that hackers use to penetrate a network security system.

- Wire transfer or advance fee scams – Hackers specifically target ecommerce shop owners and credit card users. They often ask for money in advance in exchange for a credit card or money at a later stage.

- Merchant identity fraud – This is when cybercriminals create a merchant account on behalf of what looks like a legitimate business and charge stolen credit cards. These hackers pack up shop and disappear before cardholders notice or are alerted of the illegal payments and reverse the transactions. Unfortunately, when this happens the payment initiator is held responsible for any additional fees linked to the credit card chargebacks. Additionally, they take on the burden of the lost stock.

When fraud happens to you

Now back to our imaginary friend, Eric, how could this have happened to him? Payment fraud is only a portion of a bigger consumer fraud problem. There are many ways cyber thieves work alone or in large groups to get to your business’s or your personal data. They break through sophisticated network security systems by hacking through glitches and gaps that haven’t been updated for some time. The patches help hackers avoid a firewall, making it easy to unlawfully take personal information.

Hackers can also present themselves as the representatives of banks and other credible institutions and contact credit card owners for personal information. To steal personal data the best way to interact with potential victims often involves:

- Phone calls

- Rerouting website traffic to a fake website

- Emails

- Online auctions

- Instant messages

Cybercriminals are highly advanced at stealing information online. Any business or individual can easily find themselves in the same situation as Eric.

How can you avoid fraud?

For ecommerce stores, the threat of fraud is never eliminated. Antivirus software and firewalls are built to protect against hackers that try to infiltrate your secure network. It’s important to constantly monitor and update your network security systems. However, advancements in technology tend to prove that this is also sometimes not enough. That’s why an awareness of the latest fraud trends will contribute to protecting your business from criminal activity. With that said, the best way to avoid finding yourself in a similar pickle as Eric is to partner with an experienced online payment processing company like Truevo. We have dozens of staff members working on fraud prevention every day, because we’re committed to helping you do business better and safely.

Did you learn something from this quick read? Would you like us to explore more fraud and compliance related topics? Tell us on social media: Facebook, Instagram, Twitter, and LinkedIn

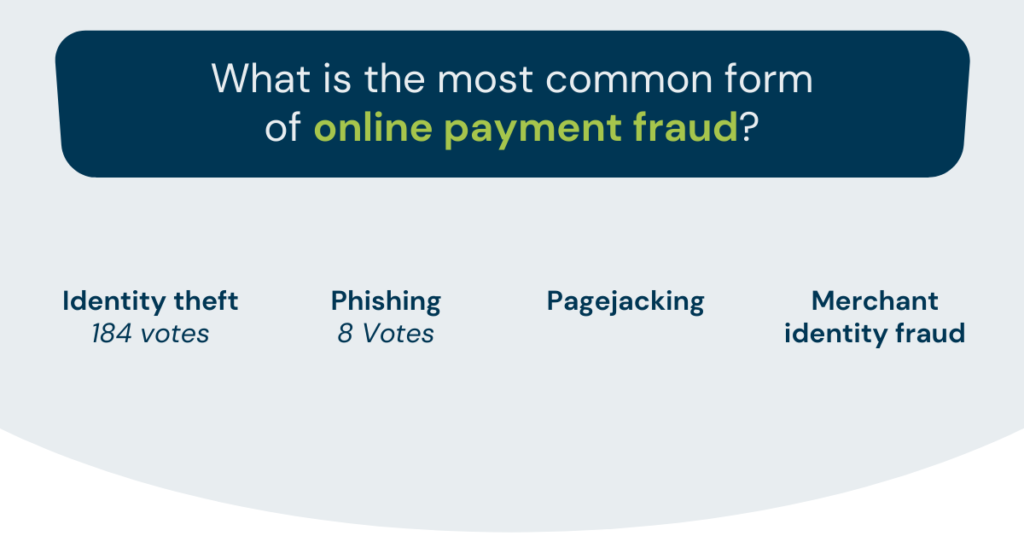

Poll

We asked on Social Media, what the most common form of online payment fraud is.

The Answer: Identity theft is the most common form of online payment fraud, comprising a tremendous 71% of all attacks. Identity fraud is often one of the methods used by cybercriminals, either as the end goal or the precursor to another attack. (Source: Ravelin)