The Payment card schemes

If you have a piece of plastic sitting in your wallet, you are familiar with payment card schemes; Visa and Mastercard… the list goes on. A whopping 52% of all non-cash payments in Europe are through these types of schemes. We are talking about €70 billion worth of payments per year!

But what is a card scheme exactly?

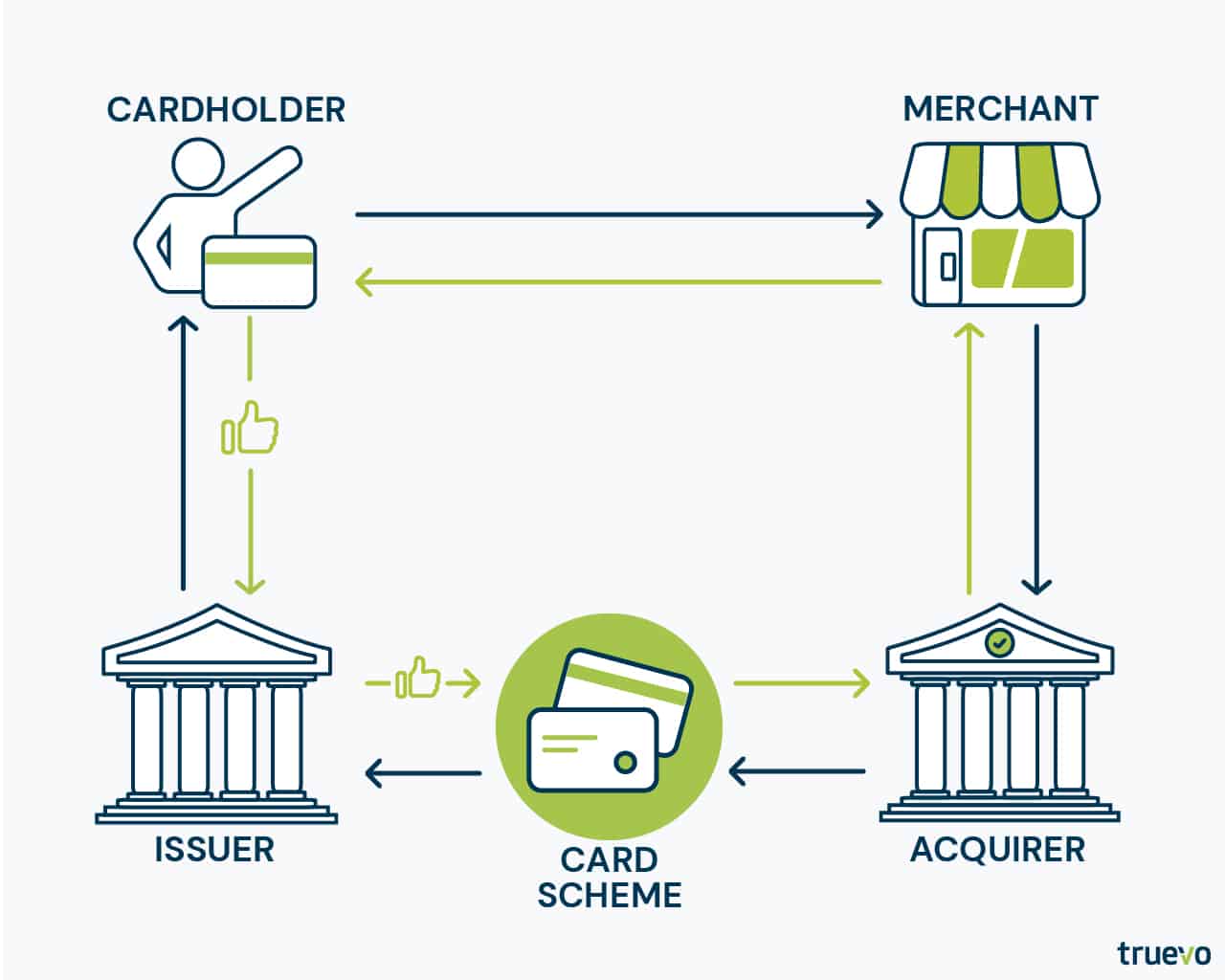

A card scheme is a framework of procedures, arrangements, networks, rules, and devices that allow a cardholder to perform a payment transaction with a third party, usually a merchant. Merchants should be familiar with card schemes. After all, without them, customers would only be able to pay with cash or cheques.

OK, So How Does a Card Scheme Work?

Card schemes are an important part of the payment process. But it’s important to keep in mind that these schemes are not banks. Visa and Mastercard do not issue cards themselves. Card schemes act as the enforcers of their policies and regulations.

Their main activities include:

- Setting the rules that govern the members of their association.

- Regulating the rules for members like acquirers and issuers.

- Setting the fees applicable for different transactions.

- Developing guidelines, procedures, and other ways to manage electronic transactions.

- Acting as the final judge in unsettled disputes between the acquirer and issuer.

- Maintaining the card network that allows the transactions.

In the last decade, most card schemes have gone public. Nowadays, they are owned by a diverse group of banks and other investors. Thus, card schemes must also ensure profits to their stakeholders. To do this, they charge fees to acquirers. Later, acquirers pass these fees to their merchants, who pay a small percentage on each transaction. These fees must comply with the EU payment service rules, for example, the EU Interchange Fee Regulation.

At the end of the day, what card schemes want is to protect cardholders. Also, to ensure only legitimate transactions are being facilitated through their systems.

The Card Scheme’s Policies and Rules

Policies and regulations vary per card scheme, but some of the most common include the following.

- Display of card symbols: Merchants are required to display the symbols of the card schemes that their acquirer accepts.

- Cardholder authority: The merchant’s responsibility is to ensure the authorisation to debit the cardholder’s account.

- Stored credentials and recurring / instalment payments: Standards must be met to keep client data secure for these types of transactions.

- Terms and conditions: T&Cs should always be visible, both in brick and mortar settings or online.

- No discriminatory surcharges: Specifically in the European Economic Area, merchants are not authorised to add any surcharge or additional fee. They cannot discriminate against one card scheme or the other, either.

- Fee assessments, refunds & chargebacks: Cards schemes have a robust set of policies and procedures to follow in these situations. They really come in handy when settlements are required.

- Protecting cardholder data: The Payment Card Industry Data Security Standards (PCI-DSS) provide guidelines to reduce the risk of debit or credit card data loss thus providing protection for both merchants and cardholders.

Communicating these rules to merchants is one of the most important obligations of an acquirer. Though acquirers should communicate this information clearly, merchants are ultimately responsible to ensure they are compliant. At Truevo, we recommend to our merchants that they refer to relevant card scheme rules like those from Mastercard and Visa to ensure they’re always up to date.

As a Merchant, How Do Card Schemes Affect Me And My Business?

Great question! Merchants will notice how card schemes affect their business when they apply to accept card payments with service providers such as acquirers. As they are onboarded and through their ongoing relationship with the acquirer, they will notice certain requirements. These requirements apply both to receive merchant accounts and to process payments which are mandated by card schemes.

Onboarding to accept payments: It is necessary for the acquirer (and the card scheme) to really know as much as they can about the merchant and their business.

Many merchants complain about how complicated this part of the process is. Especially because of the amount of documentation that they need to provide. But it’s quite necessary.

“Through our customer due diligence process, we work to verify the merchant is who they say they are. Understanding with whom we are dealing with helps the card schemes, and us, to avoid money laundering and terrorism funding, among other financial crimes. This is an intricate part of the onboarding process.”

– Claire Muscat, Head of Risk Strategy at Truevo

Ongoing risk management: Card schemes monitor chargebacks received by merchants and try to understand why they occur. If a merchant has excessive chargeback counts and is not taking measures to correct this, the business will no longer be able to accept cards.

During the acquirer and merchant relationship, the acquirer will contact the merchant to discuss selected transactions or transaction patterns. Understanding the expected transaction flow helps the acquirer protect the merchant from fraudulent activity. Good acquirers will work with their merchants to help them limit chargebacks.

What Can I Do To Comply With Card Scheme Requirements?

Have a clear customer journey

If you own a shoe store, your customer journey is easy for acquirers and card schemes to validate. But what if, for example, you own a cryptocurrency business? Your customer journey may be less straightforward. Do people deposit money through your platform to buy cryptocurrency? Do you offer a crypto wallet to store it? Can they trade through your platform? Do you offer an exchange from crypto to fiat currency? Explain every step of your customer journey on your website clearly and in a way that the customer will easily be able to grasp their potential journey.

Be clear about who you are and what your business does

Make sure that it is easy for others to understand your business. Be clear about who you are, what you do or sell, and how you conduct business. You’ll need to provide information like your business registration documents and banking details to any service provider you’d like to work with to accept payments. If you have an online business, something you might not know is that it is often difficult for acquirer’s underwriters to review websites when they need to validate the business. Being as open and clear on your website about your business and how it works will help not only your customers but your ability to process card payments.