NFC (Near Field Communication) is not just another acronym — it’s a payment method that escalated during the pandemic and is here to stay. NFC is the technology that enables people to pay by just tapping their cards — also known as contactless payments. Mastercard’s Tap and Go® is a good example. In a world where touch has almost become taboo, NFCs offer much more than the apparent benefits.

Tapping point

How prevalent are NFCs across the world? At the end of 2020, the NFC market size was $20.3 billion and is expected to double and reach $47.3 billion by the end of 2024. Two billion of the 3.4 billion smartphones worldwide are NFC-enabled, and an estimated 20% of the global population is already using this technology.

Instant connections

When two devices come into close proximity to each other, they can connect and exchange data in the blink of an eye. NFCs work at a distance of 4 cm. Users love that this can happen seamlessly without interrupting whatever they are doing. It is also convenient for businesses because NFCs are much more versatile than performing payments. Take big events. The biggest drawback of attending a massive event is the queues. NFCs can take care of that. A small tag on a smartphone, wristband or other wearable devices can store admission data and seamlessly admit those with tickets. That’s just one application that comes to mind.

Wireless and always on tap

Isn’t it remarkable that humanity could send a man to the moon in 1969? But, we will connect most of our appliances and devices via wires in 2022. It took a pandemic for the eagle to land. NFCs are a giant leap for humanity because you don’t need wires to connect two NFC devices. An NFC tag or sticker must only be near the second device to exchange data. Hallelujah!

NFCs also don’t need a WI-FI, 3G or LTE data network to exchange information. That’s a huge plus for small businesses that use POS devices to receive payments because they don’t have to invest in networks or data. Hotels and restaurants also benefit because they can receive payments and exchange information no matter how strong or weak the data or electricity network is.

Security

No technology is 100% hack safe. The benefit of NFCs and contactless payments is that you will definitely notice when somebody tries to clone your card or phone because they’d have to sit on your lap. Almost. If a hacker does manage to get hold of your device, you have various options to ensure your personal information stays yours. You can either block or track the device or stop it from working remotely. Two-factor authentication via a pin or password acts as a built-in security measure. Various providers also offer the option of limiting purchase amounts. NFCs and contactless payments are much more secure than carrying cash or flashing your leather wallet.

Applications

Here are some examples of how NFCs applications work from a report published by ResearchGate.

- Touch to connect: a device quickly checks in on social media when you visit a restaurant or show

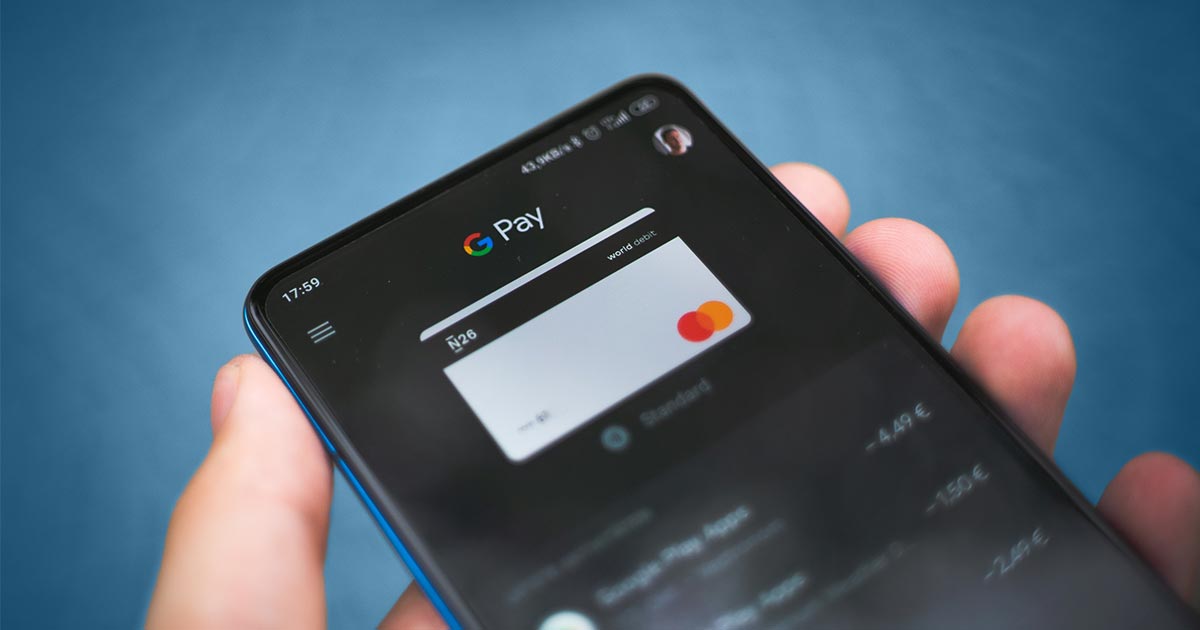

- Touch to pay: if you’re using Apple or Google Pay, you’re already using NFCs

- Touch to inform: smart parking uses NFCs to communicate open bays, directions etc. to people driving around senselessly looking for a parking bay

- Touch to entertain: theatres and cinemas can offer visitors instant tickets bypassing queues

- Touch to shop: retailers and wholesalers can develop applications that offer product information and ingredients, compare prices and automatically add products to shopping carts to enhance in-person shopping experiences

- Touch to gain access: businesses can use NFCs to do headcounts, clock hours, gain access to sensitive information or perform specific tasks

The world is our oyster to develop new and innovative ways of linking devices, IoT and doing business. If you want to stay connected to an acquirer that develops faster than most, speak to Truevo. We’ve recently introduced Apple Pay, with Google Pay on the way. We’re known for our advanced POS devices if you are running your business in a hybrid world. Connect with us. We can’t wait to do the future with you.